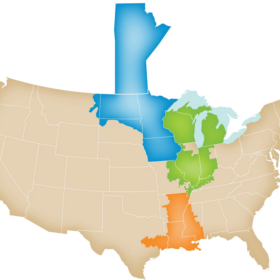

The Midcontinent Independent System Operator's renewables mix is set for a shift from wind to solar, if it can confront the challenge of transmission costs.

From pv magazine USA

The Midcontinent Independent System Operator (MISO) rarely makes headlines in solar, compared to other wholesale markets, but that might be changing.

Despite being the the oldest and largest regional transmission organization, it lags far behind the California Independent System Operator’s roughly 11 GW of solar capacity. However, if MISO’s 2020 queue of 57 GW of solar projects marked “active” is any indication, the territory could see record deployments in the coming years.

Not all of these projects will see the light of day, for a number of reasons. But if only a fraction of them are built, it would signal a major shift for a mostly wind-based MISO renewables market. More than one-quarter of the 200 GW of active projects in MISO’s 2020 generation queue are solar, but a little under half of them were projects proposed in the last year.

Today, there are only 314 MW of front-of-the-meter solar throughout the entire MISO footprint, which equates to about 0.2% of MISO’s 174 GW generating capacity. In terms of solar, the market is slightly ahead of western neighbor Southwest Power Pool, yet still behind PJM’s more than 1,500 MW of big solar.

According to Clean Grid Alliance, nearly 5 GW worth of projects were scrapped in MISO West, after they were approved, due to exorbitant transmission upgrade costs. One of the biggest challenges in the MISO interconnection queue is transmission costs – and how they are allocated.

An already low average electricity cost-per-kWh for ratepayers remains a barrier for solar in MISO’s southern reach, and utilities in the south simply have not committed to renewable energy goals like those in the north. Utilities often drag their heels rather than pursue more renewables, and this can be a problem with planning as well.

“In the end, Entergy New Orleans’ 20 MW self-build solar project was only approved once the utility dropped the transmission tie from the project, and found a distribution-only solution,” noted Logan Burke from the Alliance for Affordable Energy. “It was the policy priority of the Council for local renewables that drove that project home.”

If numbers in the queue are an indication, MISO South utilities like Entergy and Cleco would be set to change their energy mix in the coming years. Both Arkansas and Louisiana have up to 7 GW of solar projects, and roughly 500 MW of energy storage marked active in the queue.

Still, doubts remain. Entergy CEO Leo Denault indicated on Entergy’s 2019 third-quarter earnings call that the utility identified a need to build 5 GW to 7 GW of capacity in the coming years. However, much of this capacity will be gas according to Entergy Corp.’s IRPs, and Denault only seemed to imply that it could be renewables. Currently Louisiana and Arkansas have only about 200 MW of solar combined.

Plans to remedy MISO’s infrastructure will be needed, as will greater grid flexibility and demand response to be able to handle intermittent solar energy. It remains to be seen how large solar and storage projects can be developed in MISO without the savings being eaten up by transmission improvements. To ensure the economic benefits accrue to the ratepayers who are paying for it, is a matter of careful planning and also the accountability of decision-makers, and utilities within MISO.

Still, the number of projects in the queue indicates a positive trend and a change in business as usual.

Author: Andy Kowalczyk

Lắp đặt điện mặt trời Khải Minh Tech

https://ift.tt/2X7bF6x

0906633505

info.khaiminhtech@gmail.com

80/39 Trần Quang Diệu, Phường 14, Quận 3

Lắp đặt điện mặt trời Khải Minh Tech

https://ift.tt/2ZH4TRU

Không có nhận xét nào:

Đăng nhận xét