The warranty risk of solar must be addressed early in the development phase of PV projects, as it is not possible to buy warranty insurance later during the operational phase. Decisions taken by developers at this stage will remain important for the next 25 years. The good news is that an industry standard exists, and it can be easily and cost-effectively applied to most PV projects, writes Ronald Sastrawan from Munich Re.

From pv magazine 07/2020

Solar PV project developers must address many risks and find solutions to various problems. During the development phase, a developer will be heavily engaged in obtaining financing, the correct PPA, EPC and O&M contracts, required permits, land leases, and so on. Given this, “warranty-related risks” for PV modules are probably not at the top a developer’s priority list. However, it is at this stage that warranty risk should be addressed, and there are solutions at hand.

Key takeaways

Warranty risk in solar is correctly addressed during the PV module procurement phase. The first layer of PV warranty insurance comes with sourcing warranty-insured PV modules. The structure of the insurance should be assessed from the perspective of the project developer. This means that the insurance limit (maximum payout in US$) should be known and dedicated exclusively to the specific project, as it should not be shared in a pool with other projects. Also, the insurance liability period should match the warranty period, without any reduction of limit over time. Written confirmation of insurance with the name of the project owner (beneficiary) should be provided by the insurance company.

An optional “top-up cover” can be placed to increase the limit, and generally broaden the cover. This top-up cover should be discussed directly with the insurance company, so it can be tailored to specific requirements. The project owner will handle all warranty claims with the supplier and the supplier will be indemnified by the insurance. Only in the event of the supplier’s default, will the warranty claims be directly handled between the project owner and the insurance company.

Module warranties

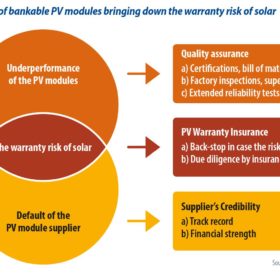

The due diligence on the PV module revolves around a key question: “Will the modules perform according to the warranty, and will my project receive indemnification in the event of module underperformance?”

Therefore, the warranty itself should be studied. A common standard is a guaranteed annual degradation of not more than 0.7% for 25 years. Double-glass modules can come with guaranteed annual degradation of less than 0.5% for 30 years. The two most important possibilities for indemnification are (i) replacement of the modules, or (ii) compensation – either via modules or financially – of the missing Wp of the underperforming modules. Of course, repair of the modules is also an option. Cost of transport, installation, and testing may or may not be covered under the warranty.

PV module warranties are a very important and strong guarantee, from the supplier to the project owner, for the next 25 or 30 years. Financial models heavily depend on them as a result. But who is actually liable if a supplier eventually goes out of business?

Warranty risk

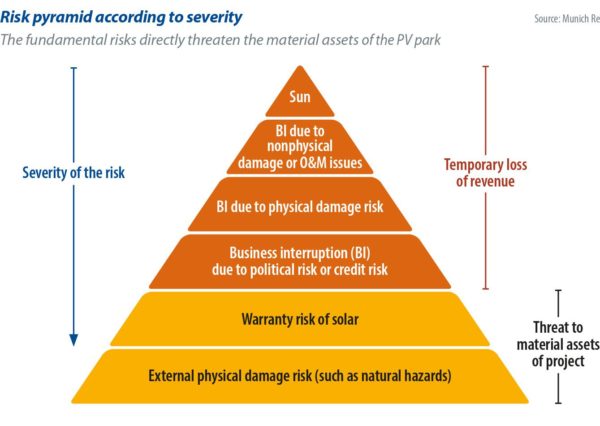

A warranty risk event is defined as the occurrence of a warranty claim in combination with the event that the PV module supplier has ceased operations. The long warranty period of PV modules poses a unique opportunity, but also a unique risk to the PV industry. There is a very real likelihood that a developer or project owner may be left alone with the useless warranties of an insolvent module supplier during the long operational phase of the project. PV warranty insurance is placed to cover this risk.

Warranty risk is a fundamental risk in PV projects. It is on a similar level as physical damage due to natural hazards, a direct threat to the PV components themselves. However, unlike natural hazards, it cannot be insured against on an annual basis, because the risk changes over time, and generally increases in later years. There would be no guarantee of annual renewal during the time when it is most needed.

Therefore, PV warranty insurance – as one key feature of sustainable PV projects – is a long-term contract and must be addressed early: during the procurement process of the modules. It should be noted that warranty insurance does not replace the due diligence process on the PV modules. It is just one important feature, among others, of de-risking PV warranties.

First layer

The first layer of PV warranty insurance comes with sourcing warranty-insured PV modules and needs to be requested directly from the PV module supplier. One place to find suppliers that are eligible to sell warranty-insured PV modules is Munich Re’s PV Warranty Partner List. To become eligible, the listed suppliers must regularly pass a due diligence process and insure at least 100 MWp annually – usually much more is insured.

But even if the supplier is not listed, a solar PV developer can – and should – request warranty-insured modules. The supplier can then apply for assessment or offer a solution from another insurance provider. At this stage, due to the long-term tail of the coverage, it is of particular importance to be aware of the financial rating of the (re-) insurer.

Furthermore, as warranty insurance comes in different shapes and sizes, it is important to understand the basics of how the warranty insurance of the component supplier is structured. The most important questions are:

“How much insurance capacity (in USD) belongs to the particular project on which I am working (the limit)?” This limit will be the maximum payout to the project from the insurance and is usually far below 100% of the modules’ sales value.

“Is the insurance capacity exclusively dedicated to my project, or is my project one of many with access to a shared pool?” The latter would result in a “first come, first served” problem. This “shared pool” structure exists in the market, and while viable from the PV module supplier’s perspective, it should be avoided from the project developer’s perspective. It is important that a solar developer “owns” its limit.

“Do I get a true 25- or 30-year cover, or is the limit reduced after year 10 or 12?” A 10- or 12-year cover period – with a limit reduction in later years – might be acceptable for certain projects, but in general, the insurance should cover the full warranty period.

“How high is the deductible for the specific PV project?” The deductible should relate to the size of the park. The deductible is an important parameter to keep the insurance premium low by filtering non-critical (small) claim scenarios.

“Does the warranty insurance transfer to me, the project owner, in the event of the supplier’s default?” Obviously, this is a key point, and written confirmation with the name of the project owner (beneficiary) should be provided by the insurance company (via the supplier) for each project owner individually. This confirmation letter can then be shown to the various stakeholders. If ownership of the project changes, the change of beneficiary must be reported to the insurance company to update this information.

It is useful, to state the most important conditions in the relevant documents, such as purchase agreement or term sheet (see the box to the right).

Most module suppliers are able to provide warranty-insured modules with the above conditions, as this is a standard in the market. Currently, a limit of not less than 5% but not more than 10% of module value for the full 25 or 30 years cover is common in the market. A deductible of not more than 5% is common.

These parameters are subject to change as market conditions change. Depending on the limit and the market conditions, this first layer should not affect costs too much, if at all.

Important Conditions

- Supplier shall obtain PV warranty insurance with the following specifications:

- Insurance Limit of at least [x%] of the module value dedicated exclusively to this project (project-specific).

- Insurance Limit for [yy] years, which does not decrease in later years and is non-cancellable.

- Coverage transfers to the project owner in the event of supplier’s default.

- (Re-) insurer has financial rating of [e.g. at least AA- by S&P].

- Supplier shall provide written Confirmation of Insurance by the insurance company stating the name, location, size of the project, and the beneficiary’s name within one month, but no later than first module shipment.

Second layer

Certain projects require a higher limit than is provided by the supplier’s warranty insurance. Under current market conditions, it is not feasible for module suppliers to provide higher insurance limits, and for most projects, a limit of 5% to 10% has proven acceptable.

Nevertheless, optional top-up cover is required for certain projects. A top-up cover is intended to increase the limit and has the option to include cost of transport, installation, and testing. The possibility of covering loss of revenue due to the underperforming modules also exists.

The top-up cover can be placed in a very easy and fast process, given that the underlying first layer is already placed. However, it needs to be tailored to the specific requirements of the project, so these should be discussed directly with the insurance company.

The insurance premium for the first layer is paid by the supplier and should not affect costs too much, if at all. The second layer is usually paid by the project developer and strongly depends on the specific requirements, mainly the limit. Once the premium is paid, the cover is active for the whole liability period of 25 or 30 years.

If the supplier is operating normally, all warranty claims should be addressed to the supplier. The supplier will handle all the warranty claims with the project owner and also with the insurance. The insurance will pay indemnification to the supplier and may get involved in verifying the warranty claim.

If the supplier is in default or has ceased operations, the insurance company should be contacted directly. Depending on the situation, a third party expert might get involved to verify the claim. Financial indemnification will be paid directly from the insurance company to the beneficiary stated in the confirmation of insurance.

Assurance and insurance

The warranty risk of solar can be mitigated easily and cost-effectively by correctly applying existing insurance standards during the procurement process of the modules. PV warranty insurance is one key feature of de-risking PV warranties, and crucial to curtail financial losses of a warranty risk event.

Warranty insurance does not replace the project developer’s due diligence and is no substitute for regular monitoring, inspection and testing of the PV modules during the operational phase. These serve as early detection mechanisms for potential warranty claims. Preventive action is always the best option, as the maximum insurance payout – with or without top-up cover – might not cover all losses.

In addition to providing indemnification during a warranty risk event, PV warranty insurance can be an advantage when a project is being sold or refinanced. Especially if the PV module supplier has since ceased operations, or quality issues of similar PV modules in other projects have been reported, an existing PV warranty insurance, especially with a strong top-up cover, can make a big difference.

About the author

About the author

Ronald Sastrawan is director of green tech solutions at Munich Re, insuring long-term risks for suppliers and developers of clean technologies. Sastrawan developed Munich Re’s PV Warranty Partner program. The program won the APVIA award for the best banking and financing initiative. It provided more than €100 million of insurance capacity in support of roughly €1 billion of solar investments within the first year of its rollout. Sastrawan has more than 15 years of experience in the solar industry. After his PhD in physics at Fraunhofer ISE, he set up factories for solar cell production in Asia and the United States. Prior to joining the Munich Re Group, he headed an R&D team in the solar production equipment industry.

Lắp đặt điện mặt trời Khải Minh Tech

https://ift.tt/2X7bF6x

0906633505

info.khaiminhtech@gmail.com

80/39 Trần Quang Diệu, Phường 14, Quận 3

Lắp đặt điện mặt trời Khải Minh Tech

https://ift.tt/2ZH4TRU

Không có nhận xét nào:

Đăng nhận xét