As p-type mono cell efficiencies edge closer to their limits, n-type cells are increasingly being recognized as next-generation technologies, writes PV InfoLink analyst Amy Fang. Manufacturers have focused their research and development efforts in recent years on the creation of commercially viable pathways for heterojunction (HJT) and tunnel-oxidized passivated contact (TOPCon) cells.

From pv magazine 05/2020

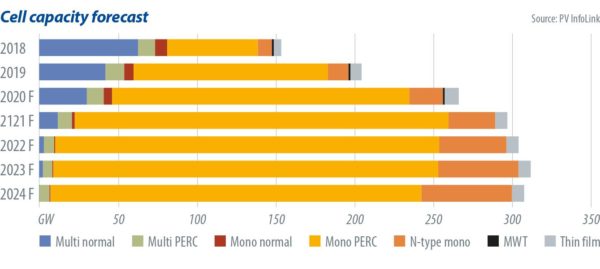

Looking back at 2018 and 2019, n-type technology struggled to gain a foothold in the market as p-type PERC (passive emitter rear contact) products offered better price performance. Consequently, most manufacturers have postponed their capacity expansion plans. However, with limited prospects for improvement on the p-type side, n-type remains a hot topic. The first quarter saw more than 8 GW of n-type capacity expansion announcements. And the emergence of Chinese n-type equipment suppliers is expected to further accelerate n-type’s growth.

Overseas demand

Chinese n-type manufacturers mainly supply utility-scale projects – assisted by China’s Top Runner Program. Although the government has stopped issuing such installations this year, some ultra-high voltage projects will use n-type modules to achieve higher power output. However, as there’s only a slight 5-10 W difference between p- and n-type modules, end users will opt for p-type PERC products, as they offer better price performance.

Overall, demand for n-type products will slow in China this year. Therefore, Chinese n-type manufacturers are eyeing utility-scale projects in emerging markets like the Middle East and Latin America.

Coronavirus slowdown

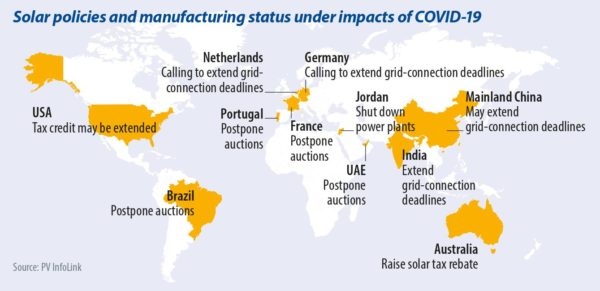

N-type demand will mainly come from non-China markets. As the Covid-19 pandemic continues to escalate, major n-type markets such as the United Arab Emirates and Brazil have started to postpone auction timelines. Fortunately as of April, construction work on some big projects is continuing in these regions. It seems that n-type demand has been delayed, but the level will ultimately remain unchanged after the pandemic. Having said that, manufacturers that mainly supply distributed-generation PV projects may have to adjust utilization rates and production volumes, as several regions have issued stay-at-home orders that will have a bigger impact on such projects.

Current state

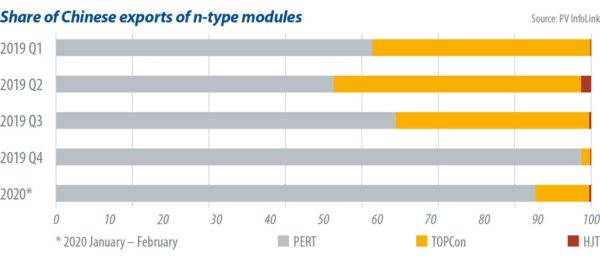

According to China customs data, shipments of n-type modules are still rising. Since 2019, n-PERT (passive emitter rear totally diffused) and TOPCon modules accounted for most n-type exports. Compared with p-type PERC cells, PERT does not offer a significant technical advantage, making it difficult to increase sales of such cells. Nevertheless, as PERT technology has reached a higher level of maturity than other n-type technologies and it could be upgraded to TOPCon, JinkoSolar took the lead on the production of PERT, sustaining the export volume of PERT modules. Since the efficiency bottleneck hinders the development of PERT, most manufacturers will turn their technology roadmaps toward either HJT or TOPCon.

TOPCon export volumes varied largely each quarter because they mainly fulfil demand from utility-scale projects. Exports of HJT modules, in contrast, were relatively low as a result of higher costs and prices.

With Chinese n-type equipment suppliers emerging this year, capital costs for the technology are gradually falling. At present, the cost of HJT equipment is around three to four times the price of a typical p-PERC line, while TOPCon is significantly less costly at no more than double the investment required for p-PERC. The yield rates have also been improved to around 90%, meaning that the total manufacturing costs could be brought down.

Many new p-PERC lines have been earmarked for an upgrade to TOPCon in the near future, suggesting that TOPCon may be the fastest-growing n-type capacity of the year. It’s expected that 5-8 GW of TOPCon capacity will be added.

The falling cost of HJT equipment will also encourage some manufacturers to invest in HJT this year. However, quite a few capacity expansions plans have yet to be executed, because it takes a longer time to adjust techniques, and most of these manufacturers are still in the R&D stage.

It is too early to tell which n-type technology will become mainstream, although TOPCon and HJT will both see improvements. The solar sector is expected to see rising capacity and production of both technologies within one to three years.

Although China’s localization of equipment helps reduce n-type costs, its speed of equipment cost reduction and efficiency improvement are still unable to compete with p-PERC. As global demand is likely to fall below 110 GW this year, prospects for n-type may turn pessimistic. Taking the economic situation into account, whether new capacity could be built, and equipment suppliers will make improvements that will play a key role in the development of n-type this year.

Amy Fang, PV InfoLink

About the author

As an assistant analyst at PV InfoLink, Amy Fang focuses on researching the solar cell segment of the PV supply chain, by providing analysis of market trends and timely market information. She supports the team in producing market trend analysis and works across price forecast and production capacity data services.

Lắp đặt điện mặt trời Khải Minh Tech

https://ift.tt/2X7bF6x

0906633505

info.khaiminhtech@gmail.com

80/39 Trần Quang Diệu, Phường 14, Quận 3

Lắp đặt điện mặt trời Khải Minh Tech

https://ift.tt/2ZH4TRU

Không có nhận xét nào:

Đăng nhận xét