The global Covid-19 crisis has had a tumultuous impact on the global economy. It has brought investment risk and purpose into sharp focus, while also bolstering sustainable finance. But what does it mean for solar? Felicia Jackson reports from London on the evolving investment landscape, with climate and social impacts becoming more prominent in financial decision making.

From pv magazine 05/2020

Climate impacts are becoming a part of investor vernacular. Environmental, social and governance (ESG) principles frequently underpin what is understood as sustainable investment. Figures from the Global Sustainable Investment Alliance’s (GSIA) last biennial report show qualifying investment assets in five major markets grew to $30.7 trillion at the start of 2018 – a 34% increase in two years. Few observers though would suggest that most decisions are being made on sustainability criteria.

Amit Bouri, chief executive and co-founder of the Global Investor Impact Network (GIIN), describes sustainable finance as investments that are made with the intention to generate positive, measurable social and environmental impacts alongside financial returns. In the simplest terms, though, sustainable finance is about horizons and long-term risk management and survival. Francis Wright, co-founder of merchant bank Turquoise International, says the approach is becoming mainstream because “the people with the money are starting to ask for it.”

Green finance

Throughout Q2 2020, pv magazine is diving deep into the topic of green finance and what it means for solar industry players, as a part of its UP initiative. Topics will include the European Green Deal, regional growth opportunities, green bonds, and the role of the carbon bubble. Stay tuned and get involved!

Sustainable finance has evolved from socially responsible investment (SRI) to corporate social responsibility (CSR), blossoming into ESG performance. And now it is moving into impact assessment. It can be broken down into seven key approaches (see table to the left) but it’s important to remember that each has different implications. These approaches can be used to allocate investments within a portfolio, define bond terms, as criteria for equity investment, or to assess how a company performs. Each can also be deployed in alignment with the Paris Agreement targets or with the UN’s Sustainable Development Goals (SDGs).

Tania Carnegie, leader and chief catalyst of Impact Ventures KPMG, explains that ESG and impact are related but different investment approaches. Impact is about creating impact or driving social and environmental change through its core business, while ESG is thinking about non-financial factors, risks and opportunities. Ben Faulkner, marketing communications director at EQ Investors, describes ESG as a “valuable tool that can be used to evaluate how certain behaviours negatively affect a company’s performance, and subsequently drive investment decisions.”

Impact investment as a sector is growing rapidly but remains relatively small. The Global Impact Investor Network (GIIN) says that impact investment accounts for just over $502 billion in investment. Richard Burrett, chief sustainability officer at Earth Capital, describes this as a rounding error at 1/160th of the ESG market.

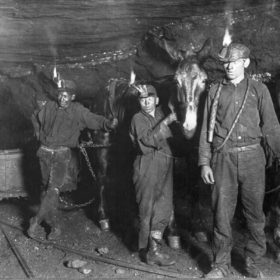

Despite its relatively small size, impact investing is making an impact. By spurring a reimagining of risk and introducing of a sense of shared responsibility, it is fundamentally changing the way investment is thought about. Instead of focusing on elements which can act as a proxy for good management, impact is about the results of decisions made. “All investors should now be reckoning with how to think about long-term performance, including investors such as pension funds and family offices,” GIIN’s Bouri says. “This crisis simply underscores that you need to think about social and environmental factors.”

Sustainable investment covers the following activities and strategies:

- Negative/exclusionary screening: the exclusion from a fund or portfolio of certain sectors, companies or practices based on specific ESG criteria

- Positive/best-in-class screening: investment in sectors, companies or projects selected for positive ESG performance relative to industry peers

- Norms-based screening: screening of investments against minimum standards of business practice based on international norms, such as those issued by the OECD, ILO, UN and UNICEF

- ESG integration: the systematic and explicit inclusion by investment managers of environmental, social and governance factors into financial analysis

- Sustainability-themed investing: investment in themes or assets specifically related to sustainability (for example clean energy, green technology or sustainable agriculture)

- Impact/community investing: targeted investments aimed at solving social or environmental problems, including community investing, where capital is specifically directed to traditionally underserved individuals or communities, as well as financing that is provided to businesses with a clear social or environmental purpose

- Corporate engagement and shareholder action: the use of shareholder power to influence corporate behavior, including through direct corporate engagement (i.e., communicating with senior management and/or boards of companies), filing or co-filing shareholder proposals, and proxy voting that is guided by comprehensive ESG guidelines Source: GSIA

Climate focus

The extent to which climate concerns are being mainstreamed within the financial system can be seen in the increased focus on stress-testing banking systems. Last year saw a call from the central bank-based Network for Greening the Financial System (NGFS) for the integration of climate-related risks into standard financial stability monitoring and supervision. The IMF is piloting new climate change stress tests, Dutch and French regulators have identified risks to insurance portfolio values and banks’ core equity ratios, and the Bank of England has proposed a methodology for climate stress testing the U.K. system in order to build resilience to external systemic shocks.

As the fundamental underpinnings of operational economics are reassessed, a key driver of investment change is the transparency agenda. As Burrett describes it, “the transparency agenda allows investors to find out what’s going on and learn how to ask the right questions.” There are two central sets of risks which companies and investors must integrate into their thinking: physical risk, but also policy, or transition, risk. This need to understand the implications of business decisions and investment choices is rapidly driving investor calls for clarity and transparency and is changing the nature of how companies do business.

In 2018 the EU introduced the Non-Financial Reporting Directive, which requires companies to report on non-financial issues. In the United States, the Sustainability Accounting Standards Board (SASB) helps companies to identify what is material to report. The Task Force for Climate Related Financial Disclosures (TCFD) has guidelines to help companies report on climate risk, requesting information on governance, strategy, risk management, and metrics and targets.

One of the challenges to the growth of sustainable finance and investment is the lack of comparable data, metrics and verification. What we are seeing today is the closer alignment of different approaches, as it becomes more and more important to understand what is happening on the ground. The GIIN recently launched its IRIS+ system, which operationalizes a range of different frameworks to help investors understand exactly what they need to measure.

There is a long way to go. This year CDSB surveyed the largest 50 companies in the EU, (with a combined market capitalization of $4.3 trillion) to understand the current state of practice in reporting under the EU Non-Financial Reporting Directive. Fiona Quinlan, technical manager at the Climate Disclosure Standards Board (CDSB), says that the report shows improvement, but notes that companies are still failing to report fully on the risks resulting from an event, such as the release of pollution. “Overall most are managing basic compliance – the quality and coherence is not up to the level investors need to make decisions,” she says.

The question is not simply what an investor is doing, but how that compares to the rest of their business or to competitors. As Ryan McNeely puts it, “if you’ve reduced CO2 emissions by 20%, is that good or bad versus your peers?”

BlackRock recently launched a GBP 250 million ($310.7 million) actively managed impact fund that is explicitly designed to address the SDGs. But with $6.47 trillion of assets under management, it remains a minority move.

“BlackRock has gotten the message but as the largest private sector institutional asset manager has a lot of problems, because it has significant AUM [assets under management] invested in passive index tracking funds carrying fossil fuel intensive exposures,” says Richard Burrett, a partner at Earth Capital Partners.

Macro developments

Combined with the current oil price war, the ongoing Covid-19 crisis could trigger a structural change in the oil market, by forcing oil companies and governments to reassess their commitment to a fossil-fueled world. The collapse in the oil prices, however – combined with the economic slowdown – is a a double-edged sword.

On the one hand, the pandemic could result in a return to business as usual, as societies work to restart their economies. “The world will face massive economic hardship and fiscal indebtedness. Governments could just think, ‘we’re trying to rebuild the health service and subsidize millions of jobs’. We just don’t have any money for a problem that doesn’t bite for 10 to 15 years,” warns Harry Boyd Carpenter, the European Bank for Reconstruction and Development’s director for energy EMEA. On the other hand, the current crisis has highlighted the global economy’s interdependence, the need to ensure the sustainability of supply chains, and the fact that the welfare of the poorest members of society can have a cascading impact on the whole. There is a growing push to center green and sustainable investment at the heart of economic stimulus for a post-coronavirus recovery.

Critically there is growing evidence that companies with robust corporate governance and sustainable business practices are more likely to survive turbulent markets and ultimately be positioned for growth in the future. Nigel Green, chief executive and founder of independent financial advisers deVere Group, notes that “even before the start of the Covid-19 pandemic, ESG investments often outperformed the market and had lower volatility over the long run. What is perhaps more impressive is that those investments with robust ESG credentials are still typically continuing to outperform throughout the coronavirus-triggered stock market crashes, where major indices have been extremely volatile.”

Francis Wright also points out that the net asset values of solar funds have been going up and that the steady dividends from renewables could provide the stable returns that pension funds are going to be looking for in volatile markets. At the same time, MSCII research shows that companies in ESG indices have a lower average cost of capital than their rivals – a huge benefit in a time of recession.

PV implications

While an increase in funds targeting sustainable development does not itself mean an increase in funds for solar, a fundamental shift in financial flows will change the nature of the industry. Many investors cite appetite but decry the lack of “investment-ready” projects and companies. There is a need to develop the robustness of the sector, from financial structuring, credit risk, and insurance arrangements. There will be increasing market pressures as competing goals clash: while solar hits targets for clean energy and climate mitigation, it may suffer in terms of land-use goals. The solar sector will need to understand the demands of new investment criteria.

Demand for projects which address a range of industrial, energy and urban challenges are likely to grow. Enabling technologies such as artificial intelligence, Internet of Things, and robotics will have an impact, while interest in the potential for green hydrogen opens up new avenues to explore. Integration across industrial sectors and new projects will bring opportunity for PV, but also require innovation in tech, processes and project skills.

The path of the Covid-19 recovery will define the development of the sector for years to come. A new, more resilient and integrated economic paradigm will bring new risks and new opportunities to the solar industry, while a return to business as usual may slow the pipeline for years.

“During the recovery we need to think about the world we want to live in,” and a growing sense of mutual responsibility and a new focus on sustainable investment should help us to achieve our goals, Bouri says.

By Felicia Jackson

Lắp đặt điện mặt trời Khải Minh Tech

https://ift.tt/2X7bF6x

0906633505

info.khaiminhtech@gmail.com

80/39 Trần Quang Diệu, Phường 14, Quận 3

Lắp đặt điện mặt trời Khải Minh Tech

https://ift.tt/2ZH4TRU