With its trade wars, exclusions from tariffs, reversals of exclusions, and stays of reversals of exclusions – in addition to the repeal of the Clean Air Act and potential changes to the Public Utility Regulatory Policies Act – the U.S. solar market is anything but boring, writes SPV Market Research’s Paula Mints.

From pv magazine 12/2019

Late in 2019, solar demand in the United States remains strong, driven by safe harbor buying in advance of the upcoming Jan. 1 decrease in the investment tax credit (ITC) from 30% to 26%. Without an extension of the ITC at its current level, demand should remain strong, with continued safe harbor buying. Should Congress act (and the president agrees) to extend the 30% ITC for another year, strong demand will continue.

The Public Utility Regulatory Policies Act (PURPA) is arguably more critical to the deployment of multi-megawatt solar in the U.S. than the ITC. With the Federal Regulatory Commission (FERC) seeking to lower the level at which utilities are required to procure energy from small producers or qualified facilities, from 20 MW to 1 MW, U.S. solar industry momentum is at risk. FERC commissioners stated that solar and wind are now mature and that the changes would bring relief to utilities. Lowering the requirement to 1 MW would have a significant dampening effect on utility-scale deployment.

Bifacial exemption

Meanwhile, in October, the International Trade Commission reversed course on its June exemption for bifacial modules, indicating that the exemption would undermine the objective of the Section 201 tariffs. The commission noted that the changed decision came about after new information became available. The bifacial exemption expired on Oct. 28, only to be stayed in November after the Solar Energy Industries Association won a temporary restraining order.

With slowing demand for solar deployment in China, presumably, there should be sufficient cells and modules available to address currently strong U.S. demand. Yet, the supply of modules is tight, with prices slightly higher in the United States than in other markets. The most likely reasons for scarcity and high prices are the ongoing tariff and trade uncertainty – and this is not going away anytime soon.

Adding to market concerns is the ongoing supply/demand imbalance, which is something the 201 tariffs were supposedly enacted to ease. The Trade Act of 1974, in theory, was designed to expand U.S. manufacturing participation in global markets and reduce trade barriers. It also – and this is important – gave the U.S. president broad fast-track authority. Under it, the president can provide temporary relief to an industry.

Petitioners have used Section 201 to gain relief from lower-priced cell and module imports, a strategy that failed because there are myriad ways of getting around tariffs, such as transshipment, absorbing the tariff, absorbing the cost of shipping, and refunding a portion of the payment.

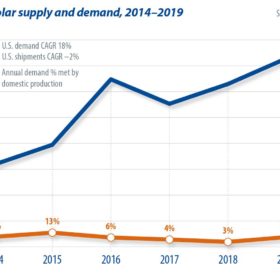

From 2014 through 2019, solar demand in the United States grew by a compound annual rate of 18% to multi-gigawatt levels, while shipments of U.S. manufactured cells/modules shrank by a compound annual rate of 2%. Though domestic module assembly activity has increased since the tariffs were first enacted, cell manufacturing has not. The cell is the electricity-producing component of the module and, thus, the most important component. The chart above plots supply and demand from 2014 through 2019.

Because of its potential for accelerated growth and even with its myriad problems, the United States is a market that solar manufacturers cannot ignore – never a dull moment.

Lắp đặt điện mặt trời Khải Minh Tech

https://ift.tt/2X7bF6x

0906633505

info.khaiminhtech@gmail.com

80/39 Trần Quang Diệu, Phường 14, Quận 3

Lắp đặt điện mặt trời Khải Minh Tech

https://ift.tt/2ZH4TRU

Không có nhận xét nào:

Đăng nhận xét