Enphase’s Q3 results show a company that has turned its fortunes around, with revenues more than doubling and high profitability, but questions remain around growth potential.

Given where Enphase was just a few years ago, the company’s Q3 2019 results would be hard to predict. After struggling under heavy losses and undergoing a massive restructuring, Enphase reported a stunning 19% operating margin, and $31 million in net income in its third quarter results.

And its growth has been nothing less than stellar. Enphase was already the second-largest inverter maker in the U.S. residential market, but during the quarter it more than doubled its revenues from this time last year to $180 million. This mostly from the sale of no less than 1.8 million microinverters, or 584 MWdc of capacity.

Enphase isn’t doing so badly with cash, either, and has reached $203 million in its coffers.

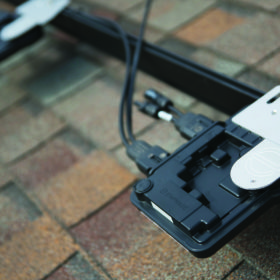

This is mostly on the back of the sales of its IQ 7 microinverter, which is now being incorporated into AC modules from major brands including Panasonic, Sunpower and Solaria. Enphase has also upgraded to its IQ 7A, to accommodate modules up to 450 watts.

Geographical matters

While we don’t have exact figures on market share, it appears that Enphase is taking a bigger and bigger bite of its core market in the United States. Here the partnership with SunPower is likely a major benefit, given that in the first half of 2019 SunPower’s installer network, if taken as one company, would have the second-largest share of the U.S. residential market after Sunrun.

Enphase is expecting further revenue growth in the range of $200-$210 million during Q4, but with a slightly lower gross margin. This has not satisfied investors, with Roth Capital described the company’s guidance as “mixed/disappointing”. The company’s stock fell in after-hours yesterday after results were released.

And while Roth still sees room for growth for Enphase in the U.S. market, it has expressed concern about the company’s international business. “Many will jump to the conclusion that Enphase’s U.S. business is done growing, but we believe the real story is how much international business has fallen off,” stated Roth in a research note.

Roth says that its own analysis shows that rest of world revenues were down 15% quarter-over-quarter in the third quarter, and may fall again in Q4. Enphase CEO Badri Kothandaraman alluded to such weakness on the company’s results call, noting that Enphase is reviewing the strategic plan for Australia, a key market.

“I am confident that this region is going to bounce back as we transition into 2020,” stated Kothandaraman.

Grid independence on the way

It is also important to note that while microinverters have traditionally been the large majority of its sales, this is not all that Enphase offers. Enphase is currently reading the third iteration of its Encharge battery, a modular 3.3 kWh unit that includes the soon-to-be-launched IQ8 microinverter. Through its Emsemble system, the company can combine solar, energy storage and a generator to stay on during blackouts, but can also integrate with the grid when power is available.

The key to this is the long-awaited IQ 8, which Enphase describes as a “grid-agnostic” battery. If the company can get this product out in time, it has a ready and eager market for battery storage in California homeowners who are experiencing repeated proactive blackouts.

Lắp đặt điện mặt trời Khải Minh Tech

https://ift.tt/2X7bF6x

0906633505

info.khaiminhtech@gmail.com

80/39 Trần Quang Diệu, Phường 14, Quận 3

Lắp đặt điện mặt trời Khải Minh Tech

https://ift.tt/2ZH4TRU

Không có nhận xét nào:

Đăng nhận xét