Looking back at the PV market in 2018, micro module technologies started maturing in development and moving on to mass production, writes TrendForce analyst Lions Shih. Modules are no longer limited to a single design as before, but rather continuing on the path toward diversification in 2019. The situation is spreading into other areas, as may be seen in the upstream silicon wafer and cell segments.

As demand grows for bifacial modules, demand for their main component – bifacial cells – grows along with it. EnergyTrend has compiled data showing the price trends of superior, high efficiency (>21.5%) standard and bifacial cells in the first half of 2019 (see graph top left) for non-Chinese and Chinese markets.

From this, we can see that price differences between superior high efficiency standard and bifacial cells will change depending on the balance reached between supply and demand. Demand is high and concentrated in the Chinese market, leading to quite frequent price fluctuations. Other overseas markets, however, do not require these products as much as China for now, so prices are rather stable and fluctuating less frequently as a result. We see that price fluctuations for standard and bifacial products are affected precisely by market acceptance.

Large-sized wafers

Besides the change in cells as a result of the development of bifacial modules, upstream silicon wafer suppliers are bringing up the idea of enlarging wafer sizes in the hope of meeting market demand for higher module output power. This could possibly be achieved by adjusting cell pitch within module packages, for example.

Around 20 years ago, PV cells were originally mass produced by four inch (later extended to five inch) fab processes, moving on to become the 156.75 mm x 156.75 mm M-series wafers in 2013. For Si wafer suppliers, larger wafers may reduce production costs while raising power output. Suppliers have therefore started the development and supply of larger wafers, even up to 166 mm in size.

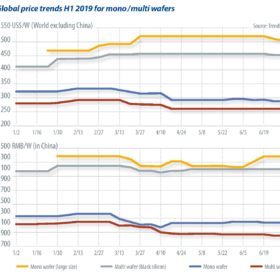

The price trends for different Si wafer sizes are quite similar to those for cells mentioned above. Theoretically, different sized wafers will exhibit differences in price, but demand remains the key factor in determining market price fluctuations. Judging from the price trends in China’s mono/multi wafer market in the first half of 2019, different-sized wafers necessarily exhibit a difference in initial market price.

That difference may be diminished amid tightening demand, as evidenced by the gap in prices between large-sized and “normal” wafers in China markets, narrowed as a result of tightening demand in May (as shown in the graph to the bottom left).

Thus, the price changes in the above two PV products both indicate that buyers have more options when products become more diversified. They also show that the variables between buyer and seller to consider in shifting market conditions become complicated as a result of that diversification. Product prices depend on demand and market acceptance, instead of their own true value.

About the author

Prior to joining TrendForce, Lions Shih worked in the photovoltaic industry for almost a decade. His research areas cover the global PV supply chain and landscape, advanced solar cell fabrication technologies, and new trends in the global solar market.

Lắp đặt điện mặt trời Khải Minh Tech

https://ift.tt/2X7bF6x

0906633505

info.khaiminhtech@gmail.com

80/39 Trần Quang Diệu, Phường 14, Quận 3

Lắp đặt điện mặt trời Khải Minh Tech

https://ift.tt/2ZH4TRU

Nhận xét này đã bị tác giả xóa.

Trả lờiXóa